Audible has changed the way it pays authors, and the reaction from the writing community has ranged from curiosity to quiet panic.

If you’ve read the announcement and felt your eyes glazing over, you’re not alone. Audible’s update touches credits, subscriptions, and the Plus catalog all at once, and the company’s explanation did not make things any clearer.

So let’s pause. Let’s take a good, long look at it. Once you strip away the corporate language, the new system is easier to understand than it first appears.

Credits still exist. Subscription plans still exist. What's changed is how Audible blends those pieces together and decides what an author earns.

So, if this new system has left you unsure about what it all means, you are exactly who this article was written for.

Let’s start with the essentials.

Key Takeaways

- Audible’s new royalty model blends credits, subscription revenue, and Audible Plus listening into one shared pool.

- Higher royalty percentages do not guarantee higher payouts because earnings depend on monthly listener behavior.

- Audible Plus now generates royalties, but it also mixes with credit revenue, which is a major concern for many authors.

- The new system is optional for now, but you cannot return to the old model once you switch.

- Authors with large catalogues or long-running series may benefit most from the new system.

- Authors who rely on predictable, credit-based earnings may prefer to stay with the old model.

Quick Timeline: How We Got Here

Before we get into formulas and royalty percentages, it helps to see how this all unfolded. Audible did not flip a switch overnight. The new model came from a mix of creator pressure, competitive pressure, and a changing audiobook market.

Here is the path that brought us to the current system.

2014: Audible Lowers Royalty Rates

Audible reduces author royalties from the original 50 to 90 percent range. This shift still influences the distrust some creators feel today.

2021–2023: Growth of Audible Plus and Buy-Out Deals

Audible expands the Plus catalog. Most titles added to Plus are paid through buy-out licensing. Authors earn nothing extra when listeners play those books inside the catalog.

Late 2023: Spotify Enters the Audiobook Market

Spotify begins selling audiobooks in the United States. The industry pays attention. Big publishers negotiate per-sale-equivalent deals with Spotify. Indie authors and smaller publishers are placed into a pooled system. This becomes an important comparison later.

March 2024: Brandon Sanderson Publicly Pressures Audible

Brandon Sanderson publishes a detailed blog post describing problems with Audible’s royalty reporting, credit system, and payout structure. He explains that Audible has been in negotiations with him and outlines some early promises the company made. Authors begin asking direct questions about royalties.

July 2024: Audible Announces a New Royalty Model

Audible quietly releases a press announcement describing a new, optional system. The company says it is based on “equity, flexibility, and insight.” Few details are offered in plain language, and early access is limited.

Late 2024: Early Access Begins

Select publishers and authors are invited into the new program. ACX starts releasing case studies. Audible emphasizes higher average royalties and better data.

May 2025: KDP’s AI Audio Documentation Raises New Questions

KDP introduces AI-narration for audiobooks. Industry reporting notes that AI-narrated audiobooks may enter Audible Plus and participate in KDP Select–related royalty structures. Authors report lower KU payouts despite steady page reads.

August 2025: Wider Rollout and Rising Concern

More creators are added. More details emerge from authors comparing old payouts to new ones. Confusion grows as people notice that credit value seems to be mixed with Plus consumption.

August 2025: Robin Sullivan Launches the Petition

A detailed petition asks Audible to revise the model. The main request is simple. If a listener uses a credit, that full value should follow the purchased title. Plus activity should be paid from a different pool. ALLi (the Alliance of Independent Authors) echoes these concerns.

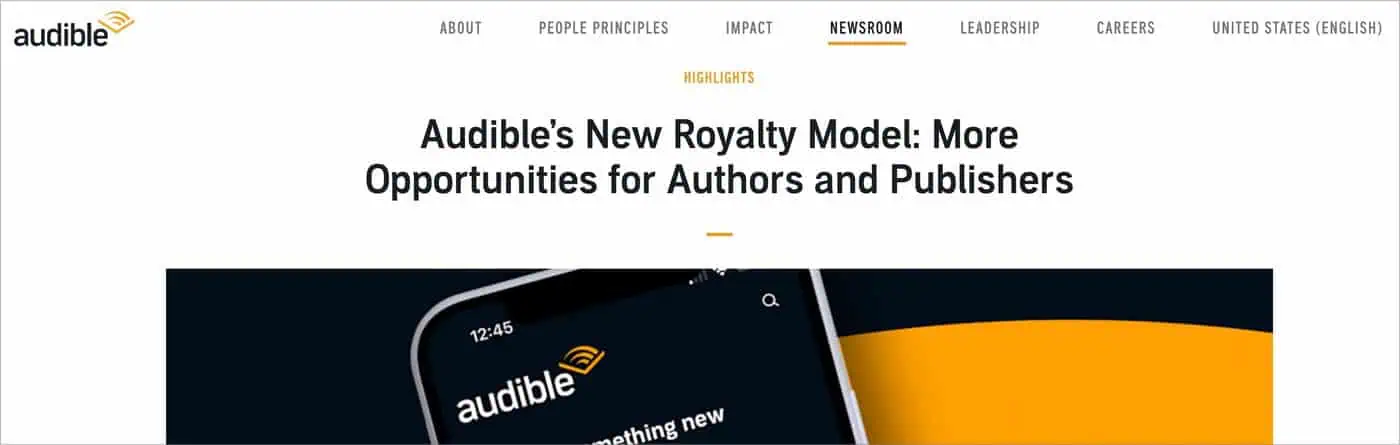

What Audible Announced (The Official Story)

In July 2024, Audible released a formal announcement describing a new, optional royalty system for audiobooks. The company said the goal was to create more “equity, flexibility, and insight” for authors and publishers.

The message was straightforward on the surface. Audible said authors would earn higher royalty percentages. They said new monthly reporting would offer more detail about listener behavior. They said Audible Plus titles would now generate royalties, something that had not been part of the old model.

Audible also said the new approach would be easier to understand. Many authors did not agree, but the official explanation described three main changes.

1. Higher Royalty Percentages

Under the new system:

- Exclusive titles earn 50 percent

- Nonexclusive titles earn 30 percent

These are increases over the old 40 percent and 25 percent rates. Audible highlighted this change in their announcement, and it quickly became the headline that spread across the author community.

2. Royalty Payments Based on “Engagement Value”

This is the part that confused most people. Audible now pays based on a calculation that blends:

- Listening time

- Subscription type

- Credit usage

- The total revenue Audible collects from monthly subscribers

All of this is converted into something Audible calls the “engagement payment rate.” That rate determines how much each book earns per period.

Audible explained this at a high level, but the details are not published in a single, clear formula. Their press announcement confirms the shift to pooled calculations but does not provide the specific math.

3. Audible Plus Finally Generates Royalties

Under the old system, many audiobooks inside Audible Plus were paid through fixed buy-out deals. Authors did not earn more when readers listened to them. Under the new system, Audible says Plus listening now participates in the same royalty pool as credit-based listening.

This was a major change. Audible positioned it as a win for discoverability and a new earning opportunity for authors who choose to place titles inside Plus.

4. Monthly Royalty Statements

Audible said creators would receive monthly royalty reporting instead of quarterly reports. They said reporting would include more listener insight and more frequent payment cycles.

The idea was to give authors a clearer view of how their audiobooks perform across both credit purchases and Plus listening.

5. Opt-In Only (For Now)

Audible confirmed that the new royalty system is optional. Authors must request access. Once approved, all new audiobooks published under that account follow the new model by default.

This is the complete summary of what Audible officially announced. Everything else in the discussion comes from reactions, analysis, data shared by early adopters, and concerns from author groups.

What Actually Changed (Plain-English Breakdown of the New Model)

Audible’s announcement sounded simple on the surface. Higher royalty percentages. More insight. More flexibility. Once you look closer, the real change is not the percentages. The real change is how Audible decides what a sale or a listen is worth.

Here is the plain-English version of what shifted.

1. Your royalty rate is no longer attached to the retail price

In the old model, Audible started with the audiobook’s retail price. They applied a standard formula and calculated the author’s royalty from that amount. The math could still feel confusing, but the price of the audiobook was a fixed reference point.

In the new model, there is no single starting number based on retail price. Audible builds a monthly revenue pool from subscriber payments and credit purchases. Author earnings come from that pool.

2. Credits and Plus listening now flow into the same revenue pool

This is the key shift behind the new model. Audible takes:

- The revenue from subscription plans

- The value of credits used during the month

- The subscription value that supports Audible Plus listening

All of that becomes one shared pool. Authors are paid from that shared amount.

This means credit-based titles and Plus titles are not separated when Audible calculates what authors earn.

3. Earnings depend on engagement, not traditional sales numbers

In the new system, Audible tracks how much each subscriber listens in a month. A subscriber who listens to twenty hours of audiobooks affects the pool differently than someone who listens for five minutes.

Your audiobook earns money based on:

- How much the listener consumed

- The type of subscription they have

- What portion of their total listening happened in your book

If a subscriber spends most of their month listening to your title, you receive a larger share of that subscriber’s value. If they only listen to a few minutes, the share is small.

4. Audible Plus becomes a discovery tool that also affects payouts

Under the old structure, many Plus titles did not earn additional money when people listened to them. Under the new model, Plus listening participates in the same shared pool.

This means a Plus listener can generate revenue for your book, but it also means Plus consumption reduces the weight of credit-only books in the pool. This is the core issue behind the petition from authors asking Audible to separate the revenue streams.

5. Authors can set retail prices, but retail prices do not drive royalties

The new model allows authors to choose their own list price. This was not possible before. Even so, the list price is not used to calculate payouts. It only influences how the book appears to customers.

Your earnings still come from the pool, not from the price you set.

6. You receive money more often, but the numbers may feel unpredictable

Monthly payments sound helpful. In practice, they reveal how variable the pooling model can be. Every month brings:

- A different total pool size

- A different number of active listeners

- A different split between credit use and Plus listening

- A different engagement pattern across genres

Some authors report higher average earnings. Some report lower. The new model creates more volatility because subscriber behavior shifts from month to month.

What Audible Says the Benefits Are

Audible has been clear about what it believes the new system improves. Nearly every official communication repeats the same themes. The company says the model creates more earning potential, more listening insight, and more opportunities for discovery.

That message appears throughout the July 2024 announcement (here's that link again), as well as in the early-access results published by ACX in August 2025.

Based on those documents, here are the main benefits Audible aims to highlight:

1. Higher Royalty Percentages

Audible points to the increase from 40 percent to 50 percent for exclusive titles and from 25 percent to 30 percent for nonexclusive titles. They present this as a meaningful improvement for creators. These percentages appear at the top of the official announcement and in multiple ACX posts that describe the rollout.

2. Royalties From Audible Plus Listening

Audible frames this as a major upgrade for authors who choose to put their titles in Plus. Previously, many Plus titles were licensed through fixed buy-out payments. Under the new model, Audible says authors can finally earn ongoing royalties from Plus listening.

This is a key selling point in both the press release and the ACX early-access report.

3. More Listener Insight and More Frequent Payments

Audible says creators will now receive monthly reporting that includes more detail about how listeners interact with their audiobooks. They also point to the shift from quarterly to monthly payouts as a benefit that gives authors a more timely view of performance.

The company describes this as added transparency, even though the community often feels the opposite.

4. Flexibility to Price New Titles

The new model allows authors to set their own list price. Audible presents this as a way for creators to position their titles competitively. While the list price does not determine earnings, it affects how a book appears to customers.

This change is highlighted by both Audible’s announcement and Brandon Sanderson’s earlier notes about the new system.

5. Better Discovery Through Audible Plus

Audible also positions Plus as a discovery tool. They argue that customers inside a subscription program are more likely to sample new authors, which can lead listeners into later books in a series or into paid titles outside the Plus catalog.

ACX’s 2025 early-access page features multiple authors who say Plus helped them gain new listeners and build momentum.

The Concerns and Criticisms (What Authors Are Worried About)

Audible has described the new royalty system as a big step forward.

Many authors are not convinced.

As more people are added to the model, the concerns have become clearer and more consistent. Some of these concerns come directly from author groups. Others come from early adopters who have compared their new payouts to what they used to earn.

Here are the main issues authors are raising:

1. The royalty percentages look higher, but payouts can still be lower

The new model advertises a higher percentage for exclusive and nonexclusive titles. The problem is that the percentage is applied to a pooled system, not a retail price. Authors who expected the higher percentages to translate into higher income are finding that the opposite can happen.

Author Media reported on this in August when several authors shared sharp decreases in earnings despite the “higher” royalty rate.

Some authors reported gains. Others saw the opposite. The results vary widely.

2. Credit revenue and Plus revenue flow into the same pool

This is the center of the conflict.

Under the new system, credit-based titles and Plus titles share the same revenue pool. The petition launched by Robin Sullivan (here's the link again) argues that this setup causes authors who remain outside of Plus to subsidize authors who include their titles in it.

The petition calls for credit-based revenue and Plus-based revenue to be separated into different pools.

3. Lack of transparency around how the pool is calculated

Audible gives a high-level explanation of how the engagement rate works, but no public source lists the exact formula. Authors cannot see how credit value, subscription revenue, and Plus listening flow to each title.

This lack of clarity has been a long-standing issue, going all the way back to Brandom Sanderson’s Regarding Audible post over a year ago.

Author groups say this continues today.

4. Early data suggests midlist authors may face the greatest risk

In pooled systems, the top of the market often rises and the middle tends to flatten. This pattern appears in other subscription environments, including Kindle Unlimited. In the early-access period, Audible highlighted success stories. The broader data is not published.

This pattern is also why some predict the model may start to resemble KU’s All-Star system over time., where top performers benefit the most. The concern appears in community discussions and in commentary from author-focused publications.

5. Audible Plus may flood the pool without raising total revenue

The increase in AI-narrated audiobooks adds another layer of concern.

Authors worry that low-cost, high-volume AI audio will increase total listening hours inside Plus without increasing the size of the pool.

That would spread revenue even more thinly.

6. Possible overlap with the KDP Select Global Fund

KDP’s documentation and prompts inside the KDP dashboard suggest that AI-narrated audiobooks created through KDP Select may share in the KDP Select Global Fund. Some authors have reported drops in their KU payouts even though page reads stayed stable. The theory is that Audible Plus listening from AI audiobooks may be drawing from the KU pool.

Amazon has not released a detailed public explanation, and this remains unconfirmed.

7. Authors worry that the old model may eventually disappear

The new royalty system is optional for now. Audible has not announced an end date for the older model. Even so, many authors fear that refusing to switch may create long-term disadvantages or lead to forced migration later.

Nothing official has been announced, but concern continues to grow as more authors are brought into early access.

Why Spotify, Storytel, and Kindle Unlimited are Part of This Conversation

Audible’s new royalty system did not appear in a vacuum. It arrived at a moment when the entire audiobook industry was shifting toward subscription models. To understand why Audible changed course, it helps to look at what happened around them.

Three companies in particular pushed the market in a new direction: Spotify, Storytel, and Amazon’s own Kindle Unlimited.

1. Spotify brought streaming pressure into the U.S. audiobook market

When Spotify entered the audiobook market, they described audiobooks as the next major part of their subscription ecosystem.

Once audiobooks were introducted, publishers negotiated strong per-sale equivalent terms. Independent authors and smaller publishers, by contrast, were placed into pooled arrangements. That difference matters because Spotify’s growth signaled a clear shift in customer behavior. More listeners began consuming audiobooks inside subscription platforms rather than through a single credit or a retail purchase.

Audible saw the pressure. Spotify had already transformed the music industry through streaming. The audiobook market was the next logical target.

2. Storytel showed that pooled systems can grow listening volume

Storytel is one of the largest audiobook streaming services outside the United States. It uses a pooled system that pays authors based on listening activity rather than fixed retail prices. Storytel has publicly said that many authors earn more from streaming than they earned from sales, especially in genres where discovery drives long-term audience growth.

This was not lost on Audible. If more listening leads to more revenue overall, a pooled system becomes attractive. Competition from Storytel and Spotify pushed Audible to modernize their own approach.

3. Kindle Unlimited demonstrated how pooled systems affect author earnings

Kindle Unlimited is the closest comparison for many independent authors. KU uses a monthly global fund and pays authors based on the share of pages read. The system has benefits, but it also introduces volatility and month-to-month uncertainty.

Audible’s new royalty model incorporates many of the same dynamics. The engagement pool functions much like KU’s fund. High-volume authors tend to benefit. Midlist authors sometimes feel squeezed. Author reactions to KU help explain why many writers approached Audible’s announcement with caution.

Why this matters for Audible’s royalty model

Audible spent more than a decade preserving the higher-value, credit-based model for audiobooks. It gave authors and publishers a path to earnings that often exceeded what streaming services offered in other media categories.

Once Spotify entered the market and Storytel continued expanding, the pressure changed. Customers were choosing subscription access. Publishers were experimenting with new licensing terms. Streaming was no longer a fringe option. It had become the mainstream expectation for audio.

Audible’s new model reflects that shift. The pooled system is not only a business decision. It is a response to how people now consume audiobooks.

What This Means for Authors (Pros, Cons, and When Each Model Makes Sense)

Audible’s new royalty system changes how earnings are calculated, how listening is valued, and how discoverability works. Because of that, there is no single choice that fits everyone. What makes sense for a large catalogue might not make sense for a debut author. What works for one genre might fail in another.

Here is a practical look at the upsides and the downsides so you can think through what fits your situation.

The potential advantages

The new system can help authors who want steady listener growth and broader visibility. Authors who write long series may benefit if Audible Plus brings new listeners into book one and leads them into later installments. High-volume listeners inside subscription plans may also generate meaningful engagement value for books that keep readers hooked for hours.

Authors who prefer monthly reporting may find the new model easier to manage. The shift from quarterly payouts to monthly statements can give a clearer view of how audience habits change over time.

Some authors also appreciate being able to choose a list price for new titles. The price does not affect royalties under the new model, but it does influence how a book appears in search results and how customers perceive its value.

The potential downsides

The biggest concern is unpredictability. A pooled system means your earnings depend on what subscribers listened to during the month, not on a fixed sale price. If listener behavior shifts, your payout shifts with it. A book that performs well one month might earn much less the next.

Authors who prefer stability may struggle with this. Authors who relied on predictable credit-based income may also find the new system more volatile. Those who do not want their books in Audible Plus may also feel disadvantaged if Plus listening grows faster than credit use.

There are also concerns about catalogue pressure. If Audible continues adding more AI-narrated audiobooks to Plus, listening volume may rise faster than the revenue pool. If that happens, authors could see their share shrink even if their own listener numbers stay steady.

When the new model might make sense

The new system may be worth considering if you have:

- A long backlist

- A strong series with an active listener base

- Titles that gain momentum when a large audience samples the first book

- A genre that performs well in subscription environments

- A plan to publish regularly

It also helps if you like experimenting. The new model rewards authors who pay attention to listener behavior and adjust their catalogue strategy over time.

When the old model might make sense

The older royalty system may fit better if you rely on predictable credit-based revenue. It may also be a better match for authors who want full control over which titles enter subscription programs. If you publish standalones or shorter works, the steadier credit-driven structure may feel safer.

Authors with smaller catalogues may prefer keeping things simple. The old model avoids month-to-month variability and makes it easier to compare an audiobook’s sales to a book’s print or ebook performance.

There is no right answer that fits every author

Audible has said the old model will remain available for now. That gives authors time to compare both structures and choose what aligns with their goals.

For some, the new system will boost discoverability and long-term growth. For others, it may cause dips in income that outweigh the potential benefits. The best approach is to review your catalogue, consider how your listeners tend to behave, and make a decision based on your own publishing pattern.

Should You Opt In? Questions to Consider

Audible’s new royalty model can look appealing or concerning depending on where you stand. The higher percentages draw attention. So does the idea of earning money from Audible Plus. The pooled system, on the other hand, makes some authors nervous. There is no single correct choice here and Audible has kept the older model available for now.

Rather than guessing, it helps to look at the decision from a few practical angles.

1. Start with the size and shape of your catalogue

Authors with large catalogues or long-running series tend to see more benefit from subscription environments. A strong first book can bring new listeners into later books that remain outside the subscription catalog. This pattern shows up often in KU and appears in some of the early-access examples on ACX.

If you have only a few titles or if each book stands alone, a pooled model may feel less predictable. A smaller catalogue has fewer opportunities to make up for a slow month.

2. Consider how your listeners usually discover you

If most listeners find you through book one in a long series, the new model might help. Audible Plus can drive a large number of samples quickly. For some authors, that creates a funnel into higher-priced titles in the rest of the series.

If your listeners are mostly credit buyers who choose based on narrator or topic, the old model may fit better. Credit-based systems reward authors whose books are chosen deliberately. The new model blends credit value with subscription value, so that distinction becomes less clear.

3. Think about how much volatility you are comfortable with

If you prefer stable, predictable royalty statements, the older model is calmer. If you do not mind short-term dips in exchange for long-term listener growth, the new system may be worth exploring.

It is also worth noting that pooled models tend to reward high-volume listening patterns. Authors in genres with long run times or binge-friendly series often see the most benefit.

4. Look at your long-term publishing plans

The new system is easier to evaluate if you plan to keep releasing new audiobooks. New listeners inside Audible Plus may move into your next book, which creates a more consistent flow of engagement.

If you publish infrequently or if you expect to step away from audio for a while, the new system may feel less aligned with your timing. The older model keeps everything tied to individual sales rather than system-wide listening behavior.

5. Compare what you earn now to what you might earn later

This is the simplest test. If your audiobook income is strong and steady under the current model, there is no pressure to change. If you feel your catalogue is underperforming or if you struggle to gain new listeners, the new model may be worth testing with one or two titles once you are invited into it.

The safest path is to compare your current results with the early-access data Audible has shared.

The early examples are positive, but they represent a small slice of authors and genres.

Remember: Opting in is optional for now

Audible has not announced a deadline for switching away from the old system. That gives authors time to watch how the new model behaves as more people join it. You can wait for additional data. You can also watch how authors with catalogues similar to yours respond.

The best decision is the one that aligns with your own publishing pattern, your audience, and your comfort with how pooled systems behave.

FAQ: Audible’s New Royalty Model

Searching the web, these questions come up often. Here are plain language answers that'll hopefully give you a clearer picture.

Final Word on Audible's Royalty Changes

Audible’s new royalty model has created a lot of debate. Some authors see opportunity. Others see risk. Most are simply trying to understand what changed and how it affects their catalogues.

The truth is that both systems can work, depending on your goals. The old model offers stability and clear payouts. The new model offers a path into subscription listening and a way to earn from Audible Plus. Neither path guarantees better results. Each has its own rhythm.

If you feel uncertain, don't fret. Audible has not set a deadline for switching. So, you can take your time. You can watch how the system behaves as more authors enter it. You can also compare your own numbers with what Audible publishes through its early-access program.

Audiobooks are growing, and the way listeners consume them is changing. This update from Audible is part of a larger shift across the entire audio market.

The more you understand about how these models work, the easier it becomes to make decisions that match your publishing plan.

Good luck.